As the saying goes, 'All work and no play makes Jack a dull boy,' but what if you could combine both to enhance your financial management skills? You're in luck because board games have evolved far beyond mere entertainment; they're now powerful tools for learning.

From the SimplyFun BankIt! to the Rich Dad CASHFLOW Board Game, we've selected six engaging board games that not only promise fun but also offer invaluable lessons in financial literacy. Each game is designed to challenge your understanding of money management in unique ways.

Curious about how these games can transform your financial savvy? Let's explore what makes them stand out in the sea of educational tools.

SimplyFun BankIt! Money Learning Game for Kids

For children aged 8 and up looking to master financial basics, SimplyFun's BankIt! offers an engaging and hands-on way to learn about money management. This board game brings real-life financial decisions into play, teaching kids how to strategize earning, saving, and spending. They'll face scenarios like paying bills and saving for a bike, making it an educational journey toward financial literacy. Through gameplay, they'll learn the value of saving and earning interest, aiming to accumulate $10 to buy a bicycle. It's not just about managing money; it's about making smart financial decisions, from donating to investing.

This game turns complex concepts into accessible, enjoyable lessons, fostering decision-making skills and promoting family bonding. With BankIt!, you're not just playing a game; you're preparing for life's financial challenges.

Best For: Families with children aged 8 and up seeking an engaging way to teach financial literacy and money management.

Pros:

- Teaches important financial skills like budgeting, saving, and investing in an interactive and fun way.

- Encourages strategic thinking and decision-making through hands-on learning and real-life scenarios.

- Durable game components and well-packaged, ensuring a long-term educational tool for both fun and learning.

Cons:

- The game's complexity might be challenging for some children to grasp without adult assistance.

The Entrepreneur Game – STEM-Accredited Board Game for Entrepreneurship & Financial Literacy

If you're aiming to sharpen your entrepreneurial skills and financial literacy, The Entrepreneur Game, with its STEM accreditation, stands as an impeccable choice. This multi-award-winning board game is designed to enhance entrepreneurship, financial literacy, critical thinking, and decision-making abilities. It's not just a game; it's an educational journey that promotes project management, investing, communication, and negotiating skills. Recognized by Newsweek Magazine's BEST IN STEM and the History Channel's Toys That Built America, it's proven to transform homes and classrooms into vibrant learning environments.

Whether you're 10 years old or older, you'll find the game's creativity-sparking and life skill-enhancing aspects invaluable. Dive into this game, and you're not just playing; you're preparing for entrepreneurial success while having fun.

Best For: Families and educators looking to teach entrepreneurship and financial literacy in an engaging and interactive way.

Pros:

- Recognized by prestigious awards and organizations for its educational value.

- Enhances a wide range of skills including critical thinking, decision-making, and financial literacy.

- Suitable for a broad age range, making it a versatile tool for learning.

Cons:

- Some feedback suggests the need for improvement in instructions and game quality.

Financial Literacy Memory Matching Game for Kids

Parents seeking an engaging way to introduce their young children to the basics of financial management will find the Financial Literacy Memory Matching Game for Kids an ideal choice. This game comes with 36 pairs of durable, easy-to-handle picture cards, designed to catch the eye and interest of preschoolers, toddlers, and kids aged 3-7. You'll appreciate how it combines fun with a foundation in financial literacy, using vibrant images and clear definitions that don't require reading, making it perfect for family bonding. Plus, it's not just about financial learning; it enhances memory, critical thinking, and problem-solving skills. Based on customer feedback, it's engaging, educational, and a hit with the right age group, despite mixed opinions on age suitability.

Best For: Parents and educators looking to introduce children between the ages of 3-7 to the concepts of financial literacy in an engaging and interactive manner.

Pros:

- Combines the fun of a memory matching game with educational content on financial literacy.

- Durable and easy-to-handle cards designed for young children.

- Enhances critical thinking, memory, and problem-solving skills alongside teaching financial basics.

Cons:

- Mixed reviews regarding age suitability, suggesting it may not be appropriate for all children within the recommended age range.

Future Fortunes Academy Financial Literacy Flashcards for Kids

Kids eager to learn about money will find Future Fortunes Academy's Financial Literacy Flashcards an engaging and effective tool. These vibrant cards simplify complex financial concepts, making them accessible and fun. By covering 52 financial terms, they lay a solid foundation for understanding money matters. Each card prompts discussion, enhancing both financial and communication skills.

Whether you're a visual, auditory, or kinesthetic learner, these flashcards adapt to your style, ensuring a comprehensive learning experience. Weighing just 5.6 ounces, they're easy to handle and ranked highly among educational tools. Customers rave about their ability to make learning about finances fun for teens, highlighting their quality, design, and educational value. With these flashcards, you're not just teaching kids about money; you're preparing them for a financially savvy future.

Best For: Parents and educators seeking to introduce financial literacy to children in an engaging and interactive manner.

Pros:

- Simplifies complex financial concepts into understandable terms for kids.

- Encourages engaging discussions between kids and adults, enhancing learning and communication skills.

- Adaptable to various learning styles, ensuring a comprehensive learning experience for all children.

Cons:

- Limited to 52 financial terms, which may not cover the full spectrum of financial literacy topics.

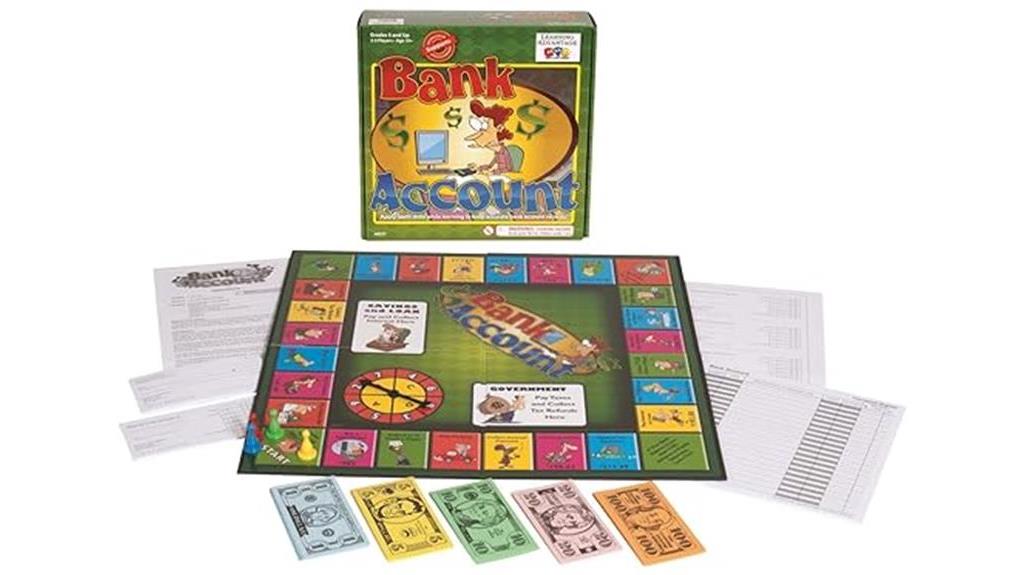

Learning ADVANTAGE-4377 Bank Account Money Game

For educators and families seeking to instill financial literacy, the Learning ADVANTAGE-4377 Bank Account Money Game emerges as a top-tier choice, engaging children in grades 5 and up with realistic money management scenarios. This game teaches financial literacy by encouraging critical thinking and strategic decision-making. Kids learn about taxes, check writing, and financial record-keeping, aligning with state and national mathematics standards. Players aim to be the first to reach $5,000 in their bank account, navigating deposits, writing checks, and reconciling accounts through realistic scenarios.

It's a hands-on learning experience, providing physical money for a practical understanding and promoting family bonding through educational fun. The game includes a board, spinner, checks, deposit slips, currency, a checkbook register, and pawns, making it a comprehensive tool for teaching how to manage a bank account effectively.

Best For: Families and educators looking to teach children grades 5 and up about financial literacy through interactive gameplay.

Pros:

- Encourages critical thinking and strategic decision-making related to financial management.

- Offers a hands-on learning experience with physical money, enhancing practical understanding.

- Supports state and national mathematics standards, integrating educational content with fun gameplay.

Cons:

- May require additional guidance for children under grade 5 due to complexity.

Rich Dad CASHFLOW Board Game for Kids (6 Player)

If you're looking to instill essential financial management skills in children, the Rich Dad CASHFLOW for Kids Board Game emerges as an outstanding choice, particularly due to its engaging approach to teaching about assets, liabilities, and cash flow. It's designed for up to six players, making it a fantastic way for kids to learn money management skills together.

The game simplifies complex financial concepts, like stock investing and real estate, into fun, interactive lessons. It's not just about having a good time; players also get to improve their basic math skills while understanding the value of money and expenses. Weighing in at 2.86 pounds and highly rated by users, this game is recommended for kids aged 6 to 10. It's an excellent tool for both kids and adults looking to boost their financial literacy in a fun and engaging way.

Best For: Families looking to teach their children financial literacy in an engaging and interactive way.

Pros:

- Teaches important financial concepts such as investing, assets, and liabilities in an understandable manner for kids.

- Encourages basic math skills and real-world application of money management.

- Highly rated by users for its ability to make learning about finance fun and engaging.

Cons:

- Some users find the kid version too simplistic and recommend the adult version for older children.

Factors to Consider When Choosing Board Games for Teaching Financial Management

When you're picking out board games to teach financial management, it's crucial to consider a few key factors.

You'll want to ensure the game matches the players' age, offers substantial educational content, and has a suitable level of complexity.

Additionally, look for games with interactive elements and a reasonable duration to keep players engaged and learning effectively.

Age Appropriateness

Selecting the right board game for teaching financial management requires careful consideration of its age appropriateness to match the child's developmental stage and understanding of financial concepts. You'll want to check the recommended age range to ensure it aligns well with the child's cognitive abilities and interests.

Opt for games that offer content and complexity that's just right to keep them engaged without feeling overwhelmed. It's beneficial to pick games that provide adjustable difficulty levels or variations, catering to different skill levels and age groups.

Make sure the game's mechanics, rules, and activities are suitable and easy to grasp for the intended age range. This approach helps in facilitating not just comprehension but also sustained engagement and effective learning about financial management.

Educational Value

After considering the age appropriateness of financial board games, it's crucial to evaluate their educational value to ensure they effectively teach financial management skills.

You're looking for games that delve into money management, budgeting, and decision-making. The best choices stimulate critical thinking and present real-world financial scenarios, making learning about saving, spending, investing, and earning interest engaging.

These games don't just teach; they offer a hands-on experience that mirrors actual financial responsibilities. Additionally, they support family bonding and interactive learning, allowing you and your loved ones to practice financial concepts together.

Opt for games with engaging gameplay mechanics that simulate financial situations, ensuring you're not just playing but also gaining valuable insights into managing finances.

Gameplay Complexity

Understanding the complexity of gameplay is crucial as you choose financial management board games that match the players' age and skill levels. Look for games that strike a perfect balance between challenge and accessibility. This ensures that players can progressively learn without feeling overwhelmed.

It's essential to evaluate the decision-making processes within the game. Ask yourself if they require strategic thinking and critical analysis, especially concerning financial concepts. Also, assess the game mechanics' learning curve to guarantee an engaging and educational experience.

Opt for games offering varying levels of complexity. This approach caters to different learning styles and preferences, fostering a well-rounded understanding of financial management principles.

Interactive Elements

Interactive elements in board games play a crucial role in teaching financial management. They actively engage players in the essential skills of earning, spending, and investing through game-based decisions. These components allow players to dive into decision-making processes, handling money in various scenarios that mimic real-life financial situations.

You'll experience firsthand the impact of your financial choices on gameplay outcomes, enhancing your understanding of budgeting, risk assessment, and strategic planning. Such interactivity not only makes learning more enjoyable but also fosters critical thinking as you navigate through challenges and opportunities.

Game Duration

When choosing board games for teaching financial management, it's crucial to consider game duration. It greatly influences player engagement and learning effectiveness. Game length can range from a quick 15 minutes to over an hour. You'll need to think about the players' attention spans and ages.

If you're aiming for younger players or brief sessions, shorter games are ideal. On the other hand, longer games provide deeper strategic experiences, perfect for detailed learning. Fortunately, some games offer adjustable lengths, allowing you to tailor the session to your time constraints and preferences.

Frequently Asked Questions

How Can Parents Effectively Incorporate These Board Games Into a Regular Educational Routine Without Overwhelming Children?

To incorporate educational board games without overwhelming kids, you'll want to gradually introduce them into playtime. Make it fun and engaging by setting aside specific times and rewarding progress with small incentives or praises.

Are There Any Online Platforms or Apps That Complement These Board Games for a More Integrated Learning Experience?

Yes, you'll find several online platforms and apps designed to complement these board games, providing a more integrated learning experience. They offer interactive lessons and challenges that align with the games' financial principles.

How Do These Board Games Cater to Children With Different Learning Styles, Such as Visual, Auditory, or Kinesthetic Learners?

These board games adapt to various learning styles by offering visual aids, auditory cues, and hands-on activities, ensuring you'll find a way that best helps you grasp financial concepts, no matter your learning preference.

Can These Games Be Adapted for Classroom Use, and if So, What Are Some Tips for Educators to Facilitate Group Sessions Effectively?

Yes, you can adapt these games for classroom use. Group players by learning style, rotate roles, and debrief after sessions. It'll make learning fun and ensure all students are engaged and participating actively.

Are There Any Success Stories or Case Studies of Children Who Significantly Improved Their Financial Literacy Skills by Playing These Games?

You're asking if playing these games has really helped kids improve their financial skills. Yes, there are success stories where children have significantly boosted their understanding and management of money through engaging with these educational games.

Conclusion

In choosing the perfect board game to boost your financial savvy, consider your learning goals and the age group you're targeting. Whether you're diving into the basics with SimplyFun BankIt! or strategizing in Rich Dad CASHFLOW, there's a game tailored to your needs.

Remember, the key is to find a game that's both educational and engaging. So, pick one from this list, gather your friends or family, and start mastering your financial management skills while having loads of fun.

Leave a Reply